All too often, technology seems disruptive and stress-inducing, especially to libraries that are already providing a full range of popular services. It’s one more thing to worry about! But, ideally, tech can augment those services and make life easier for people on both sides of the circulation desk. To give you an example, let’s talk about fines.

Fines are not extremely exciting. No one would rush to read a special “Fines Issue” of Library Journal and no one includes fines in her sentimental thoughts about libraries. But fines are commonplace in most public libraries and technology, in the form of mobile payment, can make them easier to handle.

Mobile payment (or digital wallet) platforms allow users to pay for purchases (or fines!) by using their portable electronic devices. It works through the use of NFC (near field communication) terminals. An app on the phone or smart watch is linked to a bank or credit card account. At a point of service, the device is unlocked, the user authenticates the purchase, and the app transmits payment information to the terminal. The exchange is completed without ever touching cash or a card. You don’t have to worry about uncrumpling a crumpled wad of bills or wrapping a buggy credit card in a plastic bag.

Beyond those material benefits, mobile payment also plays to the library’s traditional concerns with privacy. Most apps assign a substitute card number to the device, so the NFC terminal never receives a user’s real card or account number. With hacks becoming a more frequent concern, this ensures that actual card and account information is less vulnerable to compromise.

You’re likely to be seeing NFC terminals in more places, as they’re frequently included with the new chip-card readers that are replacing older magnetic-stripe readers. The current major players in mobile payments—Apple Pay, Android Pay, and Samsung Pay—all use NFC technology, although it should be noted that some of the newer entrants are opting to use QR codes for their financial transactions. According to one estimate, money spent through these sorts of transactions will increase from $4 billion in 2014 to $34 billion in 2019. Needless to say, all signs point to years of growth for mobile pay.

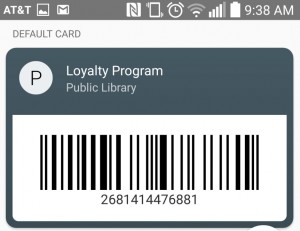

But there’s potential for more than just payment here. My Android Pay app allows me to store my library card number (which it amusingly classifies as a “loyalty card”). If my library allows it, I can then use my phone to get my books at the circ desk or self-checkout. That means one fewer card in the wallet or one fewer tag on the keyring! Additionally, the app has a feature which will alert me when I can use the card at a nearby location. It’s strictly theoretical at the moment, but a feature like this could be a boon to libraries that are offering service outside their brick-and-mortar buildings. It could help direct passers-by to a mobile makerlab or a self-service kiosk, and it’s an option that is likely to be enhanced as libraries broaden support for mobile pay apps.

Mobile pay has the potential to make library life easier without a tremendous amount of strain. It’s a great example of technology that can easily integrate into and improve existing library operations.